The project

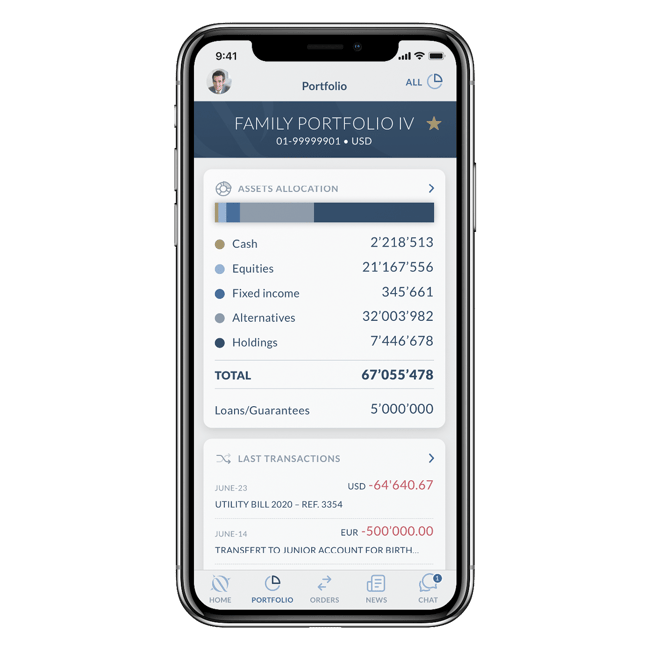

VP Bank supports a sustainable approach which takes environmental, social and governance (ESG) factors into account when investment decisions are made. For this, strict sustainability guidelines and values are applied via the ESG Rating Tool when evaluating ESG data.

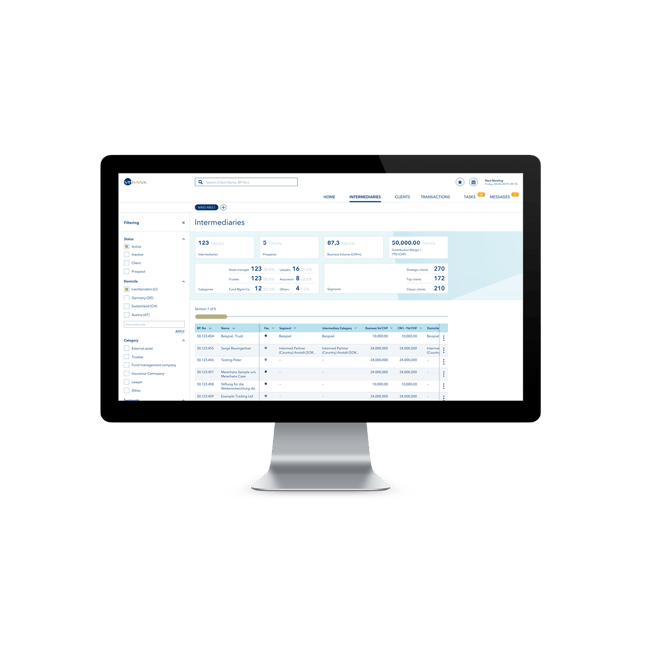

Up until now, VP Bank primarily used manual workflows and Excel sheets to calculate the ESG score, which was very time-consuming and prone to error. To speed up and modernize their processes, VP Bank commissioned Adnovum to develop an automated, user-friendly, and error-free cloud solution.